Comfort Service's

Maintenance

- Extended System Life of 3-8 Years

- 5%-30% Savings in Heating & Cooling Costs

- Improved Efficiency & Comfort

- Reduced Likelihood of Breakdowns

- Meet Warranty Maintenance Requirements

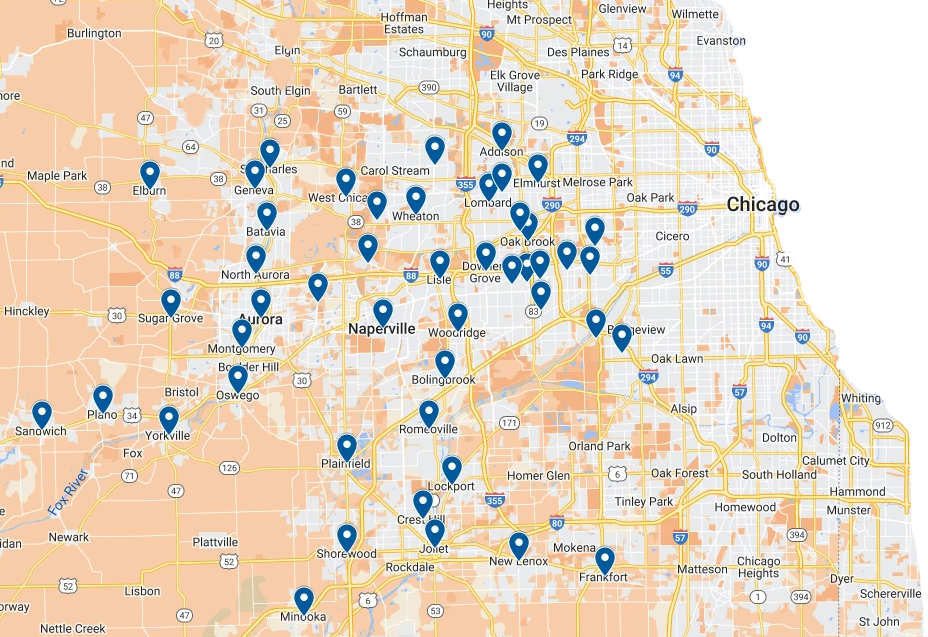

Proudly Serving

Plainfield and Surrounding

Areas Since 2006

We have convenient, flexible financing options, available upon credit approval. At Comfort Services Heating & Air Conditioning, we are committed to your home comfort and satisfaction, just give us a call if you’d like more information about our special financing options and promotional offers!

Apply Now

Apply Now

"*" indicates required fields

At Comfort Services Heating & Air Conditioning, we proudly serve

the entire Plainfield, IL area and its surrounding areas.

Reliable Heating and AC contractors are not always easy to find in Plainfield, IL, and contractors with excellent customer service are even harder to come by.

But that’s exactly what you will find when you work with our team at Comfort Services Heating and Air Conditioning, Inc. We are active in helping our community and readily translate honesty, integrity, and good old fashioned Midwestern values into our professional lives.

You can expect nothing short of exceptional service once you get in touch with us. We built our company on trust, and we promise that every job is carried out using only the most trusted materials and products.

Reliable Heating and AC contractors are not always easy to find in Plainfield, IL, and contractors with excellent customer service are even harder to come by. But that’s exactly what you will find when you work with our team at Comfort Services Heating and Air Conditioning, Inc.

We are active in helping our community and readily translate honesty, integrity, and good old fashioned Midwestern values into our professional lives. You can expect nothing short of exceptional service once you get in touch with us.

We built our company on trust, and we promise that every job is carried out using only the most trusted materials and products. And you don’t have to worry about further problems occurring once the job is done: all of our work is carried out to code so you can enjoy peace of mind for years to come.